unified estate tax credit 2021

A DC Estate Tax Return Form D-76 or Form D-76 EZ must be filed. As of 2021 estates that exceed 117 million for individuals and 234 million for married couples are subject to estate tax.

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Credit Suisse Group CS-045 Q4 2021 Earnings Call Feb 10 2022 215 am.

. IRS Publication 596. A document published by the Internal Revenue Service IRS that provides information on the earned income credit EIC available to individuals earning below a certain income. How did the tax reform law change gift and estate taxes.

Frequently asked questions about Estate Fiduciary and Inheritance taxes are listed below. The estate tax is a tax imposed on the transfer of the taxable estate of a deceased person. It will be equal to the difference between the total exemption available less the value of your lifetime gifts that.

So if your estate does not surpass that threshold you will not face a federal estate tax when your spouse passes. For additional information call 202 478-9146. The IRS will increase to 1206 million for tax year 2022.

Your estate wouldnt be subject to the federal estate tax at all if its worth 1158 million or less and you were to die in 2021. The credit is first applied against the gift tax as taxable gifts are made. Your estate tax exemption will be reduced if you made any taxable gifts during your lifetime that exceeded the annual exclusion from gift taxes 15000 in 2021 increasing to 16000 in 2022 and if you did not pay the gift tax on those transfers at the time.

The tax is then reduced by the available unified credit. All FAQ Topics DC Estate Taxes What is an estate tax. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return.

The tax reform law doubled the BEA for tax-years 2018 through 2025. The exemption is indexed for inflation so it tends to increase somewhat annually even when tax legislation doesnt affect it. To the extent that any credit remains at death it is applied against the estate tax.

The credit allows up to a 2500 tax credit annually for qualified tuition expenses school supplies or other. When must it be filed. The American Opportunity Tax Credit helps offset costs for post-secondary education.

What Is The Unified Tax Credit How Does It Change Federal Gift And Estate Taxes

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Unified Tax Credit What Is The Unified Tax Credit And Why You Should Care Waldron Schneider

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

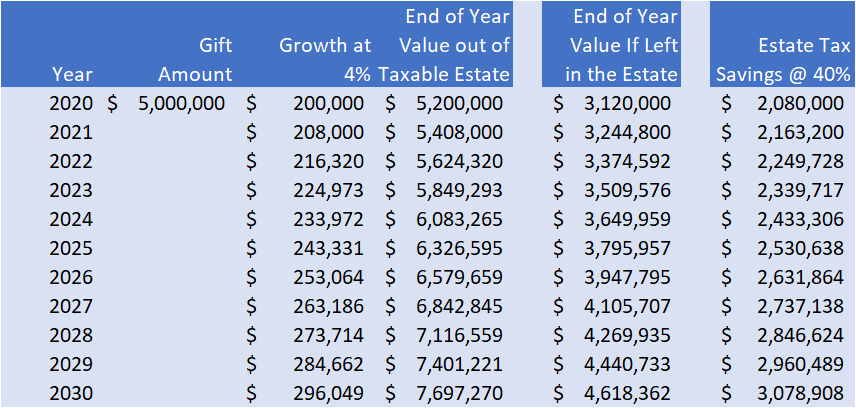

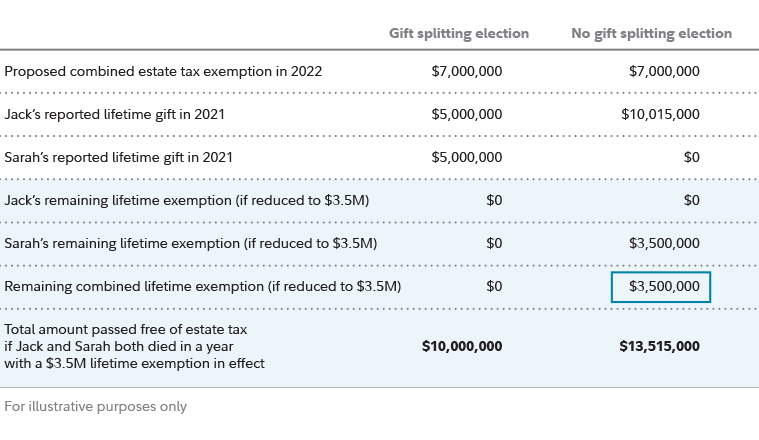

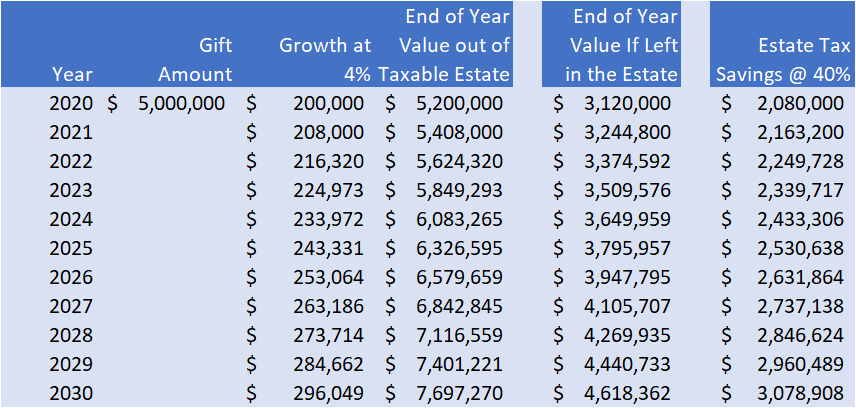

Estate Planning Strategies For Gift Splitting Fidelity

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/WhatIsaUnifiedTaxCreditAug.92021-f598bf82c87b42a7b139f10953ad3850.jpg)